In recent years, climbing costs have been one of the most pressing challenges for independent school business leaders — and the pressure continues today. Inflation has fallen since the height of COVID-19, when it was driven by supply shocks, but rising prices and the looming effects of the U.S. administration’s new tariff regime make it an ongoing concern.

As an asset management firm and research institution, Commonfund provides insights on inflation so that educational institutions can appropriately set and meet budgetary and investment goals. We have a broad view of the context for the current inflationary environment which allows us to assess how it impacts independent schools. In addition, we offer a valuable metric — the Higher Education Price Index® (HEPI) — to help school business leaders more accurately account for inflation in their budgeting and investment management.

How Macro-Economic Conditions Impact Independent School Budgeting

After several years of intense price pressures, inflation is finally showing signs of moderation, offering some relief to institutions monitoring their cost structures. After peaking near 9%, the rate now hovers around 3%. That’s still above the Federal Reserve’s long-term target but a meaningful improvement, nonetheless. This progress comes despite significant domestic policy shifts that have fueled concerns about a sustained period of higher inflation.

The environment for the Federal Reserve has grown even more complicated as we approach the end of calendar year 2025. The central bank no longer has the cushion of consistently low unemployment that once allowed it to prioritize price stability above everything else. The Fed must now balance multiple objectives: sustaining economic growth, supporting the labor market and avoiding a resurgence of inflation.

The Federal Open Market Committee (FOMC) has initiated another round of rate cuts, signaling a shift in priorities. In the struggle between curbing inflation and fostering growth, the Fed appears more inclined to support growth – even if that means tolerating inflation above the 2% target for longer. Chairman Powell has emphasized that these cuts are a preventative measure rather than a reaction to a crisis. Still, it is important to acknowledge that lower-income households and small businesses continue to feel the strain of the elevated rate environment and persistent price increases.

These shifting macroeconomic conditions have direct implications at the institutional level, particularly when it comes to budgeting and financial planning. The current environment does not make budgeting easier. Elevated interest rates and inflation remain ever present, and a once-healthy demographic trend that supported enrollment has reversed.

With so many variables influencing the budgeting process, it is important to use a consistent, broad-based measure of prices that align with an institution’s specific cost structure. HEPI explored in detail below, is a tool for both understanding historical trends and forecasting cost trajectories.

Inflation Is Increasing Pressure on Independent School Endowments

Participants in the 2024 Commonfund Benchmarks Study of Independent Schools (CSIS) reported that inflation is a top concern for their school. This is no surprise that the share of operating budgets funded by the endowment has grown, according to the study. Endowments and their investment returns are key resources that enable schools to meet intergenerational equity – that is, maintain resources for future generations – as costs and expenses climb.

NBOA’s Financial State of the Industry 2022-2024 report states that operating costs are outpacing net tuition growth – another cause for concern. A Commonfund Institute article from last year neatly explains how increased operating expenses per student are adding pressure to the endowment:

“Inflation, or the increase in operating expenses for institutions year over year, has put more pressure on fundraising efforts and endowments to contribute more to cover costs. According to NBOA data, median net tuition and fees per student increased 3.9 percent between FY2023 and FY2024, but median total operating expenses per student increased 5.4 percent over the same time period. The median gap between net tuition and fees per student and total operating expenses per student continues to grow and increased 13.9 percent between FY2023 and FY2024. This is the gap that the endowment income needs to fill.”

How Can We Measure Inflation for Independent Schools?

Independent school investment committees may strategically seek to achieve a higher rate of investment return to cover inflationary pressures. One way to do this would be to incorporate a measure of inflation into investment return targets, which CSIS data reports about one third of institutions are doing.

To adjust return targets as inflation rises, looking at your institution’s investment policy statement (IPS) would be a good place to start. This may involve an internal review or collaboration with your investment consultants or outsourced investment advisors to assess spending policy, asset allocation, risk management and more. Inflation and the importance of meeting student needs over time may also be important factors in conversations with donors.

To meet school needs on an ongoing basis, business leaders must acknowledge that inflation is a moving target. Budgeting is a continuous process, as is the investment function, which requires regular review of your IPS to ensure that investment return targets are appropriate and aligned with current needs and goals. Equally important is understanding how those targets are measured and adjusted over time.

The most commonly used inflation benchmark — CPI — may not be the best, or only, measure for independent schools to use to track and benchmark their costs and investment return targets. Considering multiple inflation measures can help you more accurately forecast your budget and investment return needs. Developed in 1961, HEPI was originally designed for higher education institutions, but we at Commonfund have found it aligns with educational institution budgets more broadly.

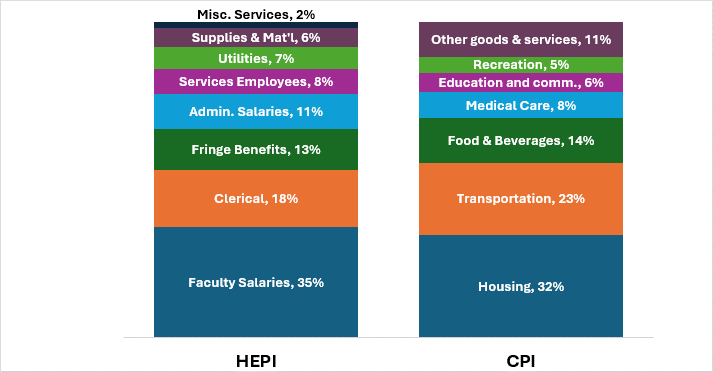

Here's a quick comparison of the benchmarks:

- CPI is a measure of a bundle of goods for consumers and households in the economy, comprised largely of housing, transportation and food.

- HEPI is a measure of categories that cover operational costs of educational institutions: faculty salaries, clerical, service and administrative salaries, fringe benefits, along with the relatively smaller components like miscellaneous services, utilities and supplies and materials.

- Historically, HEPI has exceeded CPI, which was the case in fiscal 2024. This was because wage and fringe benefit pressures persisted despite lower inflation across the economy.

The majority of the HEPI measure, as shown in the graph below, is comprised of the people that power educational institutions – the teachers, administrators, clerical and service workers. This is true for both higher education institutions and independent schools. The quarterly HEPI estimates are derived from hundreds of data points based on the educational fiscal year (June 30), which enables business leaders to match the inflation measures they use with the rest of their financial operations.

Core Components and Weights Comprising HEPI and CPI

Using inflation measures that reflect your institution’s cost structure can allow you to set appropriate goals for budgeting and investing, better predict progress towards those goals, and communicate that progress more effectively along the way.

To put this into practice we suggest exploring the following questions with your staff, committee or board of trustees:

- Does your institution’s budget look more similar to HEPI or CPI?

- Does the year-over-year growth of your institution’s operating expenses (in other words, your real inflation rate) more closely reflect HEPI or CPI?

- How can both HEPI and CPI help ensure the inflation metrics used to develop and adjust the school’s budget are fit for purpose?

As you work with your finance committee this fall to develop your school’s 2026-27 budget, this may be the ideal time to consider how HEPI might be used to serve your budgeting and investment management.