-

Planning

-

|

Safety and Security

While active shooter events draw overwhelming attention, sympathy and concern, reactions to them should not drive a school’s safety and preparedness policies, said safety experts from Kiernan Group Holdings in a recent N

2 min read

Rego provides strategic counsel and has modernized everything from collections and benefits to campus security and financial aid.

2 min read

Article by Jennifer Osland Hillen

2 min read

How is the BIIS data-collection platform different, and how can it help you?

3 min read

At some point this year, you will be looking for data points that could help with setting your school’s budget, preparing a board report or outlining a strategic plan. The time to prepare is now.

2 min read

Webinar explored Lakeside School’s use of “sustainability markers” for continued success.

3 min read

Greene's forward-thinking financial leadership boosted reserves and decreased debt, while improving facilities and expanding risk management.

2 min read

How can business officers develop an optimal working relationship with their heads of school in order to better support their schools? Peter Christian, director of finance at Windward School, and Dean Quiambao, partner a

2 min read

Could a mammoth fundraising push enable independent schools to lower tuition?

3 min read

A management framework can help schools prioritize which parts of your technology program need a revamp and where to deploy resources.

4 min read

Furlong's negotiating skills have helped Gilman remain affordable for local families.

2 min read

Article by Robert Riggar, SunTrust Bank

3 min read

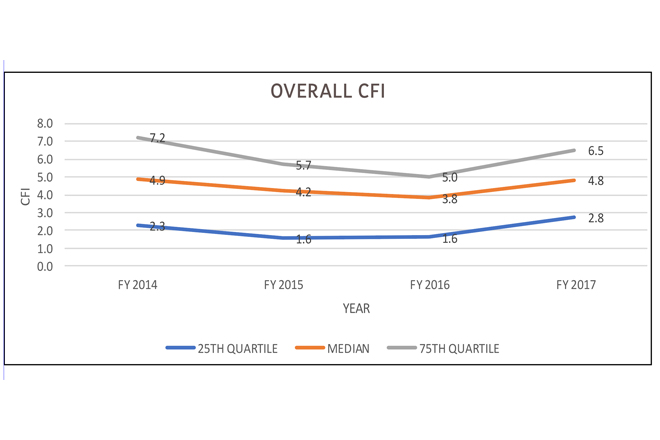

Once the province of colleges and universities, the CFI has helped early adopters in independent schools plan for long-term stability and communicate financial priorities.

4 min read

It doesn’t have to be an exercise in frustration. Tips from a 20-year audit veteran.

3 min read

5 Minutes with

-

Accounting

-

|

Risk Management

When it comes to weaknesses in schools’ internal controls, these CPAs have seen it all. Here’s how to protect your school’s finances, reputation and future.

10 min read

NetAssets.org web exclusive

2 min read

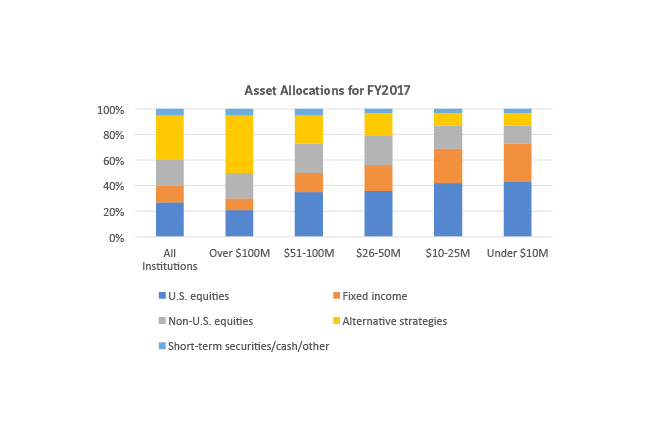

Independent school endowment returns rose regardless of school size.

2 min read

Risk & Compliance

-

Planning

-

|

Risk Management

A comprehensive plan that enables a school’s core offerings to continue after an emergency can not only save time and money during the recovery, but also foster community and connections.

4 min read

Leaders today struggle to strike the right balance between using data, intuition and judgment when making decisions.

3 min read

-

Gift

-

|

Investments

-

|

Planning

From the archives: Unexpected donations present schools with wonderful opportunities, and sometimes challenges. “It’s really hard to turn down big money.”

10 min read