Article by Jennifer Osland Hillen

Schedule B on the IRS Form 990 reveals information about nonprofit organizations’ donors and their contributions during any given fiscal year. Typically, independent schools report all donors who gave an aggregate of $5,000 or more in cash and non-cash gifts during the previous year — a potentially laborious process for advancement and business officers, given the many reconciliation issues that could arise in compiling the list of donors to disclose. You may also need to make several adjustments if your development team houses donor lists but does not necessarily keep those records on an accrual basis, which is how donors’ gifts must be reported on Schedule B.

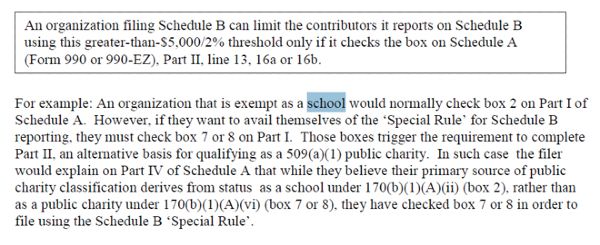

What you may not know is that Schedule B also has a special rule that could significantly reduce the reporting burden on some schools. Under this rule, schools may limit disclosures to donors whose contributions amounted to more than 2 percent of their total contribution revenue for the tax year, rather than the lower $5,000 threshold. To qualify, a school must meet a quantitative support test under Section 509(a)(1) of the Internal Revenue Code, which requires it to receive a substantial part of its support from a governmental unit or from the general public. On a very simplified basis, this calculation roughly amounts to donors who give 2 percent or more of the school’s non-tuition revenue. (Please discuss your school’s specific calculation with your external accountants.)

To be able to use this threshold, which may significantly reduce the number of donors reported, a school must initially go back and report donors who exceeded the 2 percent threshold in each of the past five years. After this “catch-up reporting,” you can use the threshold in subsequent years by checking the appropriate box on Part II of Schedule A (Form 990 or 990-EZ), either line 13, 16a or 16b. Use the same accounting method as on Part XII (Form 990 or 990-EZ), line G, Financial Statements and Reporting line 1 and Form 990-PF, line J.

For nearly every school, this means reporting donations on an accrual basis, which may require some manual reconciling between the business and advancement offices for things like verbal pledges and related pledge payments, bequests and more. (Again, you’ll want to discuss this with your external accountants.)

Schedule B also requires the name and address of the organization and EIN, and detailed information about personal, payroll and non-cash contributions. Note that Schedule B is not publicly disclosed with the rest of the 990, which is public. When sending the full 990 to your audit/finance committee(s) for review, consider omitting that schedule for privacy purposes. However, be sure that the CFO and development director, at a minimum, review the schedule ahead of time.

For further details, visit IRS.gov. Also bear in mind more recent Schedule B developments, including legislation that would prohibit the Treasury Department from requiring exempt organizations to disclose any donor information on their annual Form 990 filings, with a couple of exceptions. The House passed this bill in June 2016, but it is unclear whether legislators will resurrect support for it and send it to President Trump. April 9-27, 2018, Jennifer Hillen is teaching a three-week online course through NBOA that covers donor reporting and much more, “Stewarding Donor Dollars: Financial Reporting for Contributions."