While independent schools have been shifting to online payment systems for tuition and enrollment, they’ve been a bit slower to embrace systems for paying out invoices. But “the future is going to be a fully automated billing and paying lifecycle,” said John Zaudtke, vice president of business development at electronic payment company Paymerang.

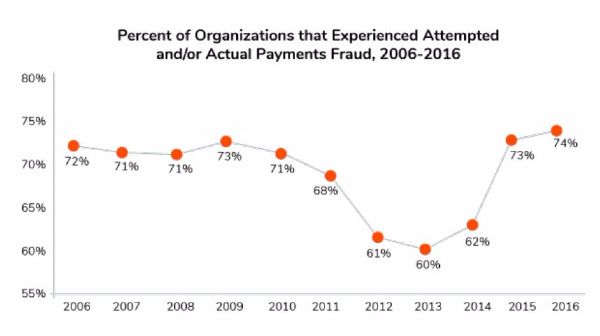

Zaudtke spoke recently to participants in NBOA’s webinar, “The Evolution of Business Payments in Independent Schools,” which covered the advantages of automated payment systems and their challenges, including ACH and check fraud. More than half of webinar participants — 61 percent — said they were still paying “mostly by check and some electronic payments.” Checks, Zaudtke said, are a “fraud-laden process, time consuming, not scalable and the most expensive form of payment.”

Paymerang and other companies like it operate as a third-party hub for B2B payments. Zaudtke calls it a “business processing outsourcing organization.” Paymerang has a fairly simple system in which a school uploads its vendors’ information and then funds the payments. Paymerang then remits the payment — in the way the vendor wants to receive it, whether by paper check, ACH or virtual card — and passes along any rebates (of which Paymerang takes a percentage) to its client.

Streamlined and Safer

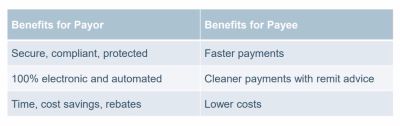

Collegiate School in Richmond, Virginia began using Paymerang in January 2013, and according to Jenn Quindoza, Collegiate's controller and risk manager, the school has seen tremendous savings, even just on postage and check stock. Before switching to the online system, Collegiate’s business office spent $5,300 a year on postage. “That’s gone down to $3,800, which is a 28 percent savings after postal increases every year,” Quindoza said. “And we used to send 800 checks a month; now we send 200. Vendors love it because it’s a faster system and the payments are more secure.”

We used to send 800 checks a month; now we send 200. Vendors love it because it’s a faster system and the payments are more secure.

Jenn Quindoza

Collegiate School

The biggest plus to using the system, Quindoza said, is the rebates the school receives every quarter. “Since 2013, we’ve gotten over $100,000 in rebates.”

The rebates work this way: When Paymerang is able to pay a vendor using a virtual card, Paymerang “typically gets the interchange that the vendor has to pay to process,” Zaudtke said. Paymerang keeps a portion to run its business, and “we give a portion to our client as a reward.”

The other benefit, Quindoza said is that each month’s bank reconciliation is more streamlined. “We were clearing those 800 checks every month manually, whereas now, we’re clearing a few checks and four ACH debits a month…that represent all of those payments. That has saved our accountant significant time.”

Safety issues were important to Quindoza, and she likes the electronic process because the school issues fewer paper checks. She also pointed out that because Paymerang has so many security precautions in place, she only needs to “one electronic approval and not two signatures” for payments.

It took Collegiate about three months to get up to speed on the system — most of the work constituted “sending notes to vendors telling them we were going all-electronic,” Quindoza said. But after “three or four months, using the system was like clockwork.”

She also spoke about two downsides. Since Collegiate still has to cut some checks — like parent reimbursements and some employee benefit bills — “there is still some fragmentation.” And, the other downside for Quindoza is that the process only takes care of the back end of accounts payable. “My dream,” she said, “is to have the front end too, the electronic invoicing.” She is currently looking into Concur, which does that and could work in tandem with Paymerang.

Zaudtke responded that Paymerang is working on a front-end solution, too. “That’s the future of payables.”

NBOA members and webinar attendees can view the full presentation, slides and transcript at NBOA.org.