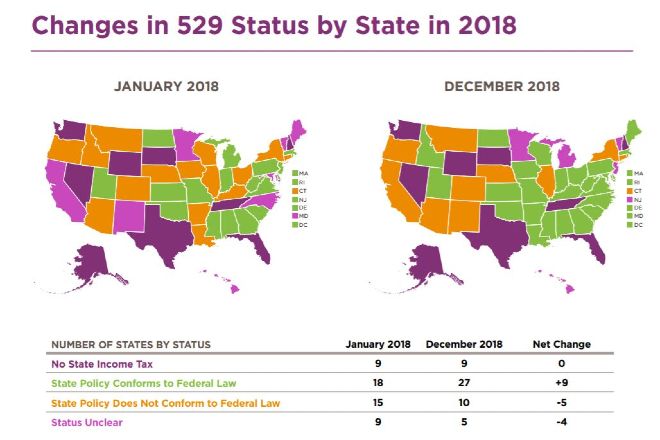

Feature image: Map shows how states have or haven't changed their state policy to conform to new federal policy regarding 529 plans. Image from the Education Commission of the States's policy brief, "529 Education Savings Plans: Federal Action and State Policy Trends."

Since 1996, 529 education savings plans have enabled families to save for college and get tax-free investment growth. Following passage of the Tax Cut and Jobs Act in December 2017, federal law regarding 529 plans now extends beyond higher education to include K-12 independent education.

The federal government authorizes 529 plans, but states sponsor the accounts, which means tax benefits vary by state. To further complicate matters, not all states have changed their laws to conform with the new federal ruling allowing 529 funds for K-12 private education. “Only just over half of the states have enacted the [2017] legislation, which has left a lot of administrators and families at independent schools wondering what the ruling actually means for them,” said Jennifer Osland Hillen, NBOA’s vice president of professional development and business affairs.

A new policy brief from the Education Commission of the States helps answers some of these questions. Under federal law, 529 account holders can spend up to $10,000 a year from a 529 account on private K-12 school tuition and fees. But while some states have policies that conform to federal law, others have policies that do not conform or are unclear or pending. In 2018, four states passed laws that exclude use of 529 funds for private K-12 education, 11 passed laws that allow it, and two states introduced pending legislation. Federal law does not impact states with no income tax.

All states and D.C. offer 529 plans, either on their own or in partnership with another state, but the plans have different incentives and benefits. State policies may have one or more of the following five features:

- Tax-free growth: States that have income tax allow post state-tax contributions to grow free of additional state taxes.

- State income tax deductions: Most states allow a limited deduction on state taxes, between $1,000 and $5,000, for 529 contributions. A few states offer larger deductions; seven offer no state tax deduction.

- Matching state funds: Eleven states offer a direct or matching contribution to those opening 529 savings accounts. Five states have discontinued matching programs.

- Account limits: Most states limit the amount beneficiaries can receive, which is usually $300,000-$500,000. Account holders can hold multiple 529 accounts and can transfer beneficiaries of 520 accounts.

- Penalties for unqualified expenses: Federal law stipulates that account holders who spend 529 savings on unqualified expenses must pay deferred federal taxes as well as a 10 percent penalty. All states with an income tax require 529 account holders to repay any deferred state taxes on unqualified expenses. A few states have additional penalties.

For more information, read the full brief from Education Commission from the States. If you have questions about these issues with regard to K-12 schools, contact Jennifer Osland Hillen, NBOA vice president of professional development and business affairs, at jennifer.hillen@nboa.org.