Interview By Leah Thayer

Melissa Orth is chief financial officer and chief operating officer of Greenhill School, a preschool – 12 day school with 1,290 students in Addison, Texas. She began her two-year term as chair of the NBOA Board of Directors in July of 2015.

1

Who were your early influences?

Orth: Definitely my parents. I grew up in Omaha, Nebraska, the oldest of three girls. Both of my parents are from the Midwest and were always driven, hardworking and inclined to lead by example. My mom was a teacher and spent about two-thirds of her career teaching gifted education. My dad was in business management and coached our athletic teams. My parents were very present and supportive, but they expected a lot from all of us. We grew up knowing we needed to do our best.

2

What were your first jobs?

Orth: I spent the summer after 8th grade detassling corn. Then I worked at the Dairy Queen. Later, I worked at the call center of the company my dad worked for, providing authorization codes for credit card transactions. In college at Kansas State, I worked in the spirit store selling university and Greek apparel. My parents said I could go to college anywhere I liked as long as it was in Kansas or Nebraska!

3

When did you get the business bug?

Orth: When I graduated from high school in 1982, I knew I didn’t want to go into college without having a direction. I had read in some periodical that CPAs were the doctors of the business world — being one could give you entrée into a variety of fields. I also heard accounting was a strong profession for women, and since I was a strong math student I decided to pursue accounting and business at Kansas State. By the time I graduated in 1986, the “Big Eight” public accounting firms were recruiting, so I started at Arthur Andersen that summer.

4

You spent 10 years with Arthur Andersen. How did those years inform you?

Orth: I was lucky to start with a group of bright, driven recruits my age. We began with three weeks of training in Chicago alongside a diverse group of people from all over the world. Within a year, I got married, moved to Texas and transferred to the Dallas office. The Monday after my husband and I closed on our house, the stock market crashed.

I remember an Andersen partner telling me these were unprecedented times. Nationally, the S&Ls were failing, banks were failing, new banks were forming, the country was headed into recession. Here in Texas, oil was falling. All of this impacted our work directly. My first client was a large bank that failed, became another bank and eventually went through a series of name changes. I felt like I spent my first year in the downtown tunnels of Dallas, auditing all the different facets of this huge financial institution. Meanwhile, there was an “up or out” mentality in public accounting that created a competitive, fast-paced environment. I liked working with smart people and a variety of organizations, but it could be frustrating to only be able to make recommendations as a consultant without ever finding out whether they were implemented.

5

What prompted your shift to the nonprofit world?

Orth: My work at Andersen had exposed me to a lot of nonprofits, including foundations, museums and big organizations like Mothers Against Drunk Driving and the American Heart Association (AHA). I enjoyed working in the not-for-profit sector more than any other, and I came to understand that it was my calling and passion. When I was offered the opportunity to become vice president of finance at the National Office of the AHA, I stepped into a position of managing an entire financial department consisting of 15 CPAs and six clerical and administrative staff. My four years there were tremendously active and rewarding.

One of our biggest challenges at AHA involved the merger of 56 state-based organizations into a single legal entity. At the time I had two tiny children, but I spent a huge amount of time flying around to the different affiliates, helping them restructure and working on issues like brand management, financial effectiveness and risk management. Another aspect that stood out was the commitment to mission that almost every person had.

6

You moved to Greenhill School in 2000. How was the learning curve?

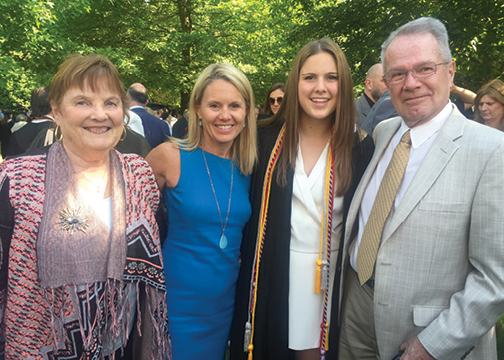

Orth: I hadn’t been thinking about leaving AHA, but an Arthur Andersen partner and mentor happened to know the treasurer of Greenhill’s board, who mentioned in passing that they were looking for a new CFO. The stars just seemed to align. At the time, my daughters were four and six, and the school seemed a perfect fit for them both as well.

I was actually surprised by the similarities between AHA and Greenhill. Obviously their governance structures differed in that AHA had a national board and Greenhill’s board was mostly local, but they followed similar not-for-profit accounting practices and had similar objectives regarding decision-making and spending priorities. In a for-profit business, you focus on where you make the most money; it’s an objective, cut-and-dried approach. In not-for-profits you need to define which metrics are more meaningful. This isn’t always so easy because although you can easily track outputs, like how many flyers you mail or how much money you raise, it can be harder to measure actual outcomes.

7

How was your relationship with the head of school?

Orth: A fortunate aspect of my introduction to Greenhill was that the new head of school and I were hired within a couple of months of each other. Scott Griggs and I had a partnership from the first day. He had worked his entire career in independent schools and shared with me his inside-out understanding of the industry and its traditions. I was able to help him by bringing a lot of experience involving financials, operations and governance.

I was also lucky that the Greenhill board wanted a CFO who could serve in a strategic role: determine who sits at the table, gets answers to the right questions, identifies the right data points, formulates an executable plan. Unlike many independent school CFOs, I was fortunate that I didn’t have to convince anybody that I could and should operate in that capacity.

8

You’re known to place a very high premium on data. Why is this, and how do you use data to inform decisions at Greenhill?

Orth: Data plays an important role in supporting everything from intuitive reactions to strategic planning to how you evaluate programs and initiatives. Our membership in INDEX (Independent School Data Exchange) helps us track information from local and national peer schools, and we also collect and analyze longitudinal data with regard to Greenhill School itself. And while financial data is obviously really important, we recognize that we need to see the whole picture: operational data, academic data, admissions data, personnel data, and how they all correlate with each other.

Admissions data, for instance, can reveal early signs of softness at certain grade levels. I remember when the Northeast started to see softening of the lower-school market around 2008 and 2009. If you continue to see this kind of trend for multiple years, it can point to significant demographic changes in your area — or maybe the need to revisit your tuition model. While the Southwest region is still fairly strong relative to the nation overall, we did a branding initiative some years ago to turn around a declining trend among upper-school boys. The decline wasn’t significant, but it was enough to move us to make some changes to our targeted marketing.

9

How have you seen the business officer profession change over the years?

Orth: Certainly within the regulatory environment there has been much more focus on not-for-profits and making sure they’re run like true businesses. There’s a lot more regulation involving human resources and financial reporting, which has driven the emergence of HR specialists within independent schools. When I started at Greenhill, one of the first things I did was to create an HR department. The HR function is so important and carries a tremendous amount of risk.

10

Can you name a few accomplishments at Greenhill that you’re especially proud of?

Orth: I’ve found construction projects to be very rewarding. Most recently, we built a new performing arts center that is an iconic building on our campus. My biggest project prior to that was in 2004, when we built a brand new lower-school complex and significantly expanded our upper school. Not only is it gratifying to see something go from a hole in the ground to an incredible space, but it’s incredibly rewarding to work with such a variety of people, from architects and consultants to the general contractor. There’s nothing quite like knowing you had a significant role in creating something that will be a defining factor of the campus for generations.

The new lower-school facilities also offered us the opportunity to create a child development center for children from infancy to age 5. Being able to offer child care to our employees has been incredibly rewarding and is truly valued by faculty.

We’ve spent a lot of time on our financial aid program. We are 100 percent need-blind in admissions, and we’ve worked hard to administer the program in a way that helps families both afford tuition and take advantage of all programs. It’s been gratifying not only to have a generous and well-oiled financial aid process, but also a support budget that helps fund ancillary expenses that are an important part of campus life.

We’ve done a lot to increase our revenues from auxiliary and after-school programs as well as facility rentals. In 15 years, gross revenues from these programs have increased from a little over $1 million to $5 million. Besides the financial benefits, these produce intangible benefits in bringing people on campus who may not have known about Greenhill otherwise. About 75 percent of our summer program participants are not Greenhill students, and history shows that some will get excited about the campus, apply and become students.

11

Can you share some lessons on delivering construction projects on time and on budget?

Orth: Pricing it right is critical. Develop realistic assumptions about construction costs as well as fundraising needs. And closely monitor both ends, paying close attention to change orders, contingencies, design costs and opportunities to value-engineer. We’ve never used an independent owner’s representative to manage our construction projects. That model is helpful for some schools, but we’ve been very comfortable with our decisions and have appreciated having direct day-to-day contact with the construction team.

It’s also been important to involve the right people — to have a good partnership with the architect and GC, and to communicate at a high level with the proper stakeholders at the school, including donors, members of the board and staff and faculty who will be using the new spaces. We always provide our board with a comprehensive reporting package summarizing details on the campaign side as well as the expenses side: all costs, borrowing, what’s been incurred so far, estimated costs going forward. My general rule is to not enter into any major project in a vacuum. Always make sure your major donors and the people who will be using the space have put their stamp on it.

12

You recently developed a comprehensive primer on financial sustainability with your finance and audit committee. What’s your advice for educating the board on financial matters while keeping them at the 30,000-foot level?

Orth: It seems financial sustainability has been a key topic at NBOA conferences for at least the last 10 years. At Greenhill, we actually developed a financial sustainability task force in 2008 – 2009, somewhat in alignment with the economic downturn. The entire issue is top of mind every time we visit our financial goals as well as when we develop our annual budget and five-year projections, but it helps to take a deep and broad cross-functional look at your staffing, programs, business model and other key business drivers to determine ways to slow the trajectory of tuition increases.

13

Let's switch gears to your role as NBOA’s board chair. You’ve been in this role for a year. What are your aspirations for the second year?

Orth: There are really four: 1) Ensuring that our new directors are well-assimilated and that we’re leveraging their various talents and experiences. 2) Continuing to focus on the strategic plan, including broadening our focus to all aspects of the business officer’s role. 3) Continuing to strengthen our partnership with regional and national groups. 4) Continuing to support Jeff and the NBOA staff.

14

You’ve mentioned that the profession has changed. How have NBOA and the NBOA Board of Directors responded to these changes?

Orth: We’ve worked hard to offer new professional development programs and tools to recognize the broad responsibilities of the business officer, including institutional risk management, HR, technology, facilities and governance, as well as serving as a strategic partner to the head of school and board. NBOA’s HR program is probably the most recognizable aspect of this expansion and responds to new regulations impacting not-for-profit organizations and therefore our schools. Hiring Grace Lee as NBOA’s vice president, legal affairs, was certainly a strategic move, as was developing the HR toolkit. We’ve also stepped up our focus on facilities as a significant asset and area of risk management, and sharpened our focus on accounting and financial reporting. Educating our members about upcoming FASB changes may not be the most exciting part of our job, but it’s an important one.

15

What is your charge for the growing number of NBOA schools? How can they help the association advance the business officer profession and the mission of their schools?

Orth: Get involved! Network. Share. Advocate for the importance of the financial and operational function in the strategic and overall health of our institutions.